STEP ONE

Select the right program plan for you:

STEP TWO

Select the right timeline:

- Full-time

- Advantage: Full immersion and quicker completion.

- Part-time

- Advantage: Continue working while in the program; spend more time digesting the material covered in class and during projects.

STEP THREE

Identify the best way to pay for your education:

- Secure a loan

- Apply for a Diversity Scholarship

- Explore the Washington State Worker Retraining Program

- Pay with a credit card

- Pay the full tuition upfront

If you’re trying choose which option is right for you, follow this guide to weigh the pros and cons of each option.

Student Loans

Student loans help to keep your savings intact for other uses, can offer low APRs, and provide flexibility in selecting a payment option that works best for you.

So how do you choose a lender? Here’s what to watch for and what questions to ask when you research a loan financier:

- Their business model: Why do they do what they do?

- Are there teaser rates or is everything upfront?

- How will your work history and current salary affect your interest rate?

- Will your interest rates be fixed or variable?

- How does your credit score affect loan terms?

- What is your origination fee?

- What is the total APR on your loan?

- Do you have co-signer options? Will you be penalized for not using a co-signer?

- How long does it take to apply?

- Can they finance your tuition deposit?

- Are cost-of-living loans available?

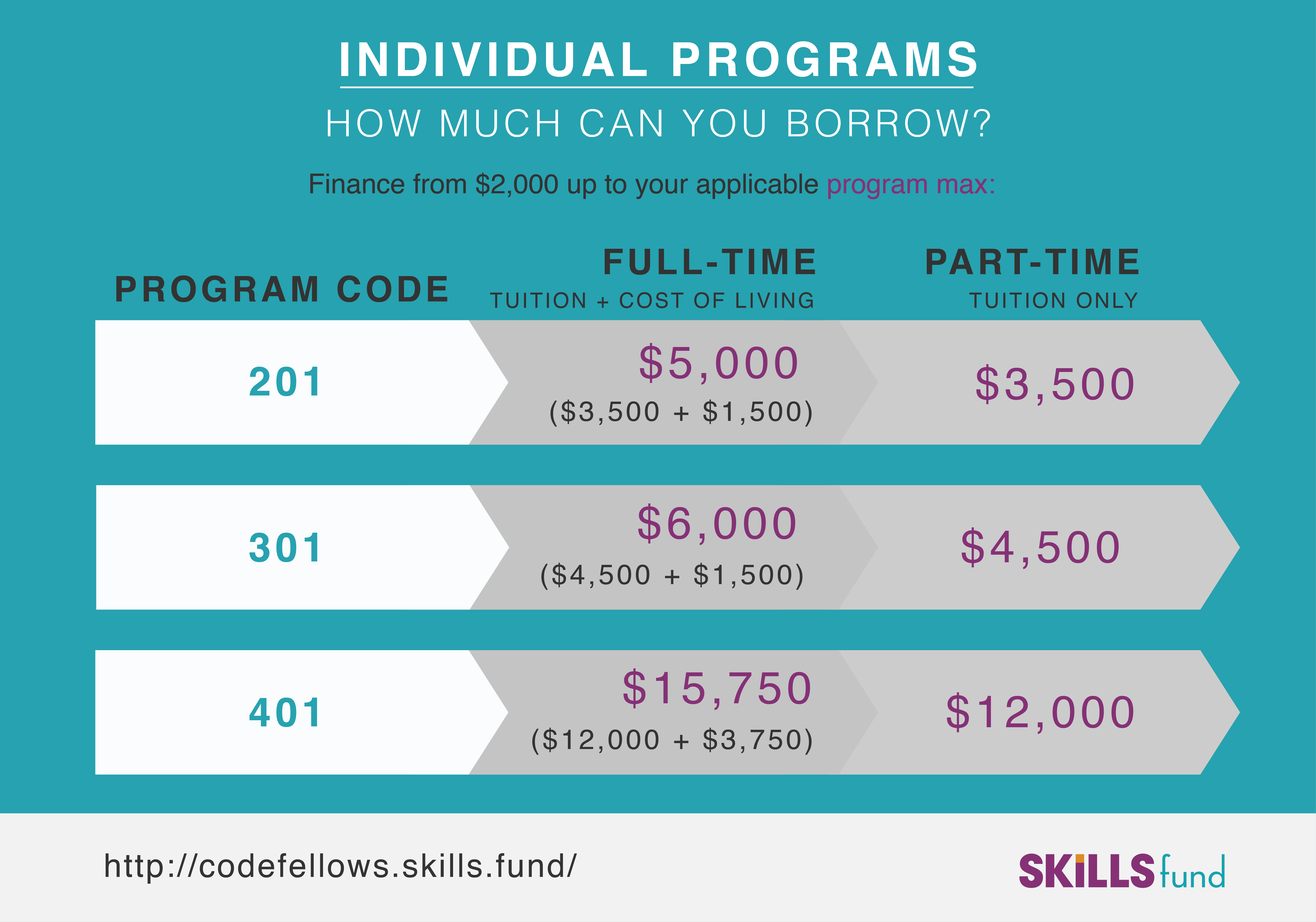

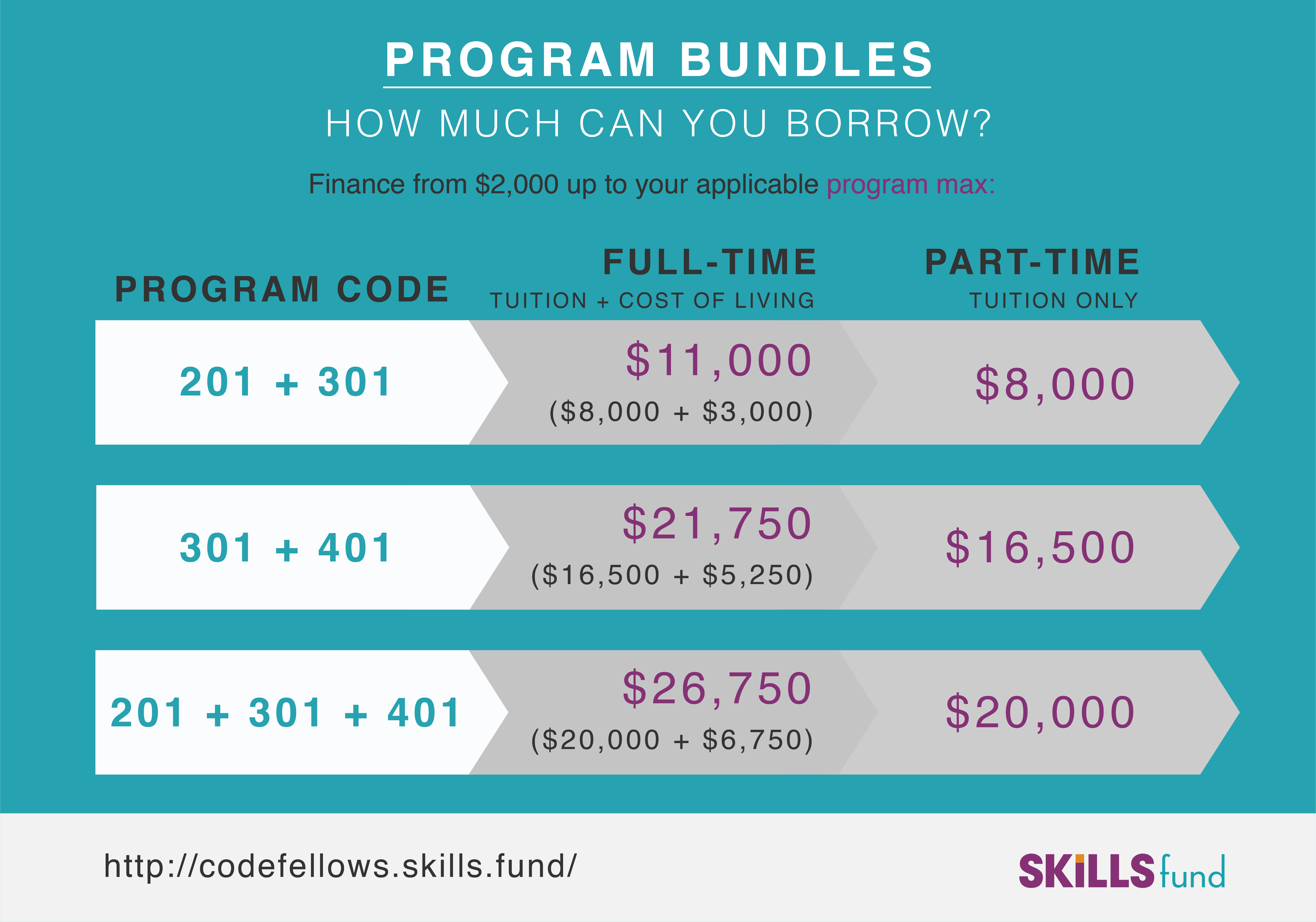

If you’re ready to explore financing, below you’ll find the full breakdown based upon your program of choice with Skills Fund:

Financing Bundles

- Tuition and cost-of-living financing (full-time only)

- Know your interest rate, general APR, and monthly payments before applying

- Full repayment (interest + principle) grace period // no prepayment penalties

If you have questions about tuition, financing, scholarships, or anything else about Code Fellows’ program, please get in touch!